Retail Real Estate - Hypermarkets - Pre to Post Pandemic and Future Prospects

Hypermarkets sell a variety of items at one location, including foodstuffs, clothing and travel essentials, creating a one-stop shopping experience for the shoppers.

Hypermarkets sell a variety of items at one location, including foodstuffs, clothing and travel essentials, creating a one-stop shopping experience for the shoppers.

In 1666, while rebuilding London after the Great Fire, the Government allocated space for shops on Principle Streets. The reason behind this Government initiative was to regulate trade by increasing visibility of businesses. These Principle Streets became known as 'High Streets'.

The uncertainty in the global economy continues to exist as we complete the second year of the COVID-19 pandemic. Many industries are still facing the impact but with aggressive vaccination drives taking place, the world can finally go back to its pre-pandemic days in the coming months.

The Coronavirus pandemic had an unprecedented impact on Indian Real Estate, with all property transactions coming to a complete standstill between March and June of 2020 when the whole country went into an indefinite lockdown.

In Fractional Investment, a number of investors join together and pool in funds to invest in Grade-A, high-return commercial real estate assets so that all of them can benefit from a share of the income that the asset generates, and can enjoy the profits from any appreciation in the value of the property.

Fractional ownership has emerged as the solution for average citizens seeking to circumvent the financial barriers of making profitable investments in commercial real estate. Unlikethe traditional concept of 'ownership' of property which by definition means sole ownership of property, fractional ownership refers to 'shared ownership' where an investor owns only a fraction of the property.

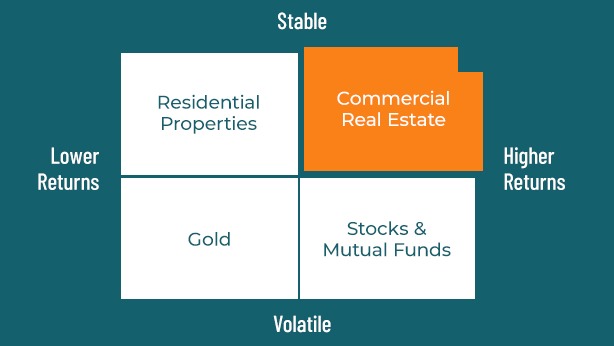

Land and Real Estate have always been considered to be the safety area of investment. Real estate values are always on the rise due to India's increasing population coupled with decreasing land availability.

The gradual unlocking of cities, mass vaccinations and the drop in infection rates is giving hope to businesses looking for a chance to recover in the second half of 2021. With business opportunities on the rise even now, new workplace trends being implemented and increasing demands for office spaces, commercial developers are looking forward to a quick recovery of the commercial office real estate market.

After the COVID-19 pandemic shook up the word in full force in 2020, standard business operating procedures and models experienced a total disruption and a complete paradigm shift. Additionally, the behavior and expectations of employees completely changed and companies had to take notice and act on the same. As a result, firstly companies had to shift to remote working arrangements right away.

It has been more than a year that work-from-home has become the norm and employees are getting accustomed to the arrangement, instead of the usual 9 to 5 in-office hours, 5 to 6 days a week. With lockdowns now being lifted, companies are trying to evaluate the positives and negatives of the return to offices, WFH and hybrid working arrangements.

Despite the pandemic, the fast growing 3rd party logistics, E-commerce, FMCG, Retail and Pharma sectors have turned up as the saving grace for the Realty sector. This has in turn has led to a boom in the Logistics and Warehousing real estate segment with an expected investment inflow expected to touch INR 495 billion in 2021.

In 2019, the warehouse automation market in India was valued at INR 202 billion. The market is expected to expand at a compound annual growth rate of 13.38% during the 2020-2024 period, to reach a value of INR 421.5 billion by 2024.

The real estate industry in India, in terms of warehousing grew by 77% from 2019 to 2020. When COVID-19 hit India, the crippling effect of the pandemic coupled with lockdowns across the nation halted production, disrupted the supply chain, and restricted international trade. This negatively impacted the warehousing sector, causing a drop in demand by 11% in the first quarter of 2020.